NEW STARTUPS

Startups that you can invest in with as little as $100 right now:

🍴 TableOne - Subscription-based access to top restaurants (LINK)

🧛 Vampire - 37-year old wine & spirits brand, sweet investing perks (LINK)

🏠 Trained - AI that cuts mortgage costs (LINK)

84 MONTHS OF TRACKING MY FINANCES

For the past 7 years, I've kept meticulous track of my net worth.

Every single month, I pull up everything - retirement accounts, stocks, real estate - hell I even calculate how much cashback I've accumulated.

It's one of my favorite activities to do, even if it wasn't a good financial month for me.

I just like tracking things - goes all the way back to my days as a kid cataloguing my entire 3,000 baseball card collection by hand onto 20+ sheets of paper.

Today I want to share how I - a 30 year old man living in Brooklyn - am allocating my investment portfolio.

What I do works for me, but I'm not saying that this is gospel for everyone to follow.

Let’s dive in.

MY VERSION OF THE BARBELL STRATEGY

I’d say that my investment style is an adaptation of the barbell method.

For anyone unfamiliar, the barbell investing strategy is a portfolio approach that balances extreme safety with extreme risk — while intentionally skipping the middle.

Popularized by Nassim Nicholas Taleb in his book The Black Swan, the barbell strategy gets it’s name from the visual image of where the the two extremes sit on the risk scale.

The biggest misconception is the split between risk and safety. Most people assume that just like barbells in the gym, the amount the on each side is equal to one another.

This is not the case - the barbell strategy advises that the bulk of your capital (often 80–90%) should go to ultra-safe assets like Treasury bills or cash, and put a small, contained portion (10–20%) into highly speculative, high-upside bets like startups, crypto, or options.

what the barbell strategy actually looks like

The logic behind the barbell is rooted in risk asymmetry. Most traditional portfolios (like the familiar 60/40 stock-bond split) spread risk across a wide range of asset types, aiming for balanced returns and moderate volatility.

But the barbell flips this on its head. By keeping most of your money in assets that protect against loss, you ensure survival even in turbulent markets. Meanwhile, the small high-risk portion gives you exposure to rare, outsized wins — the kind that can deliver transformative gains without endangering your entire portfolio.

HERE’S WHERE I DIFFER (SLIGHTLY)

Now I said that my portfolio is a slight adaptation of the barbell strategy, for two reasons.

I’m fairly young and without kids, so I have an outsized appetite for risk. Normally my ‘high-risk’ assets exceed 20% - I’ll explain shortly why that’s not the case in the current economic setting.

I’m not a strict avoider of the barbell middle. I’ve always liked investing in a handful of individual stocks which I would consider to be pretty close to the middle of the risk spectrum.

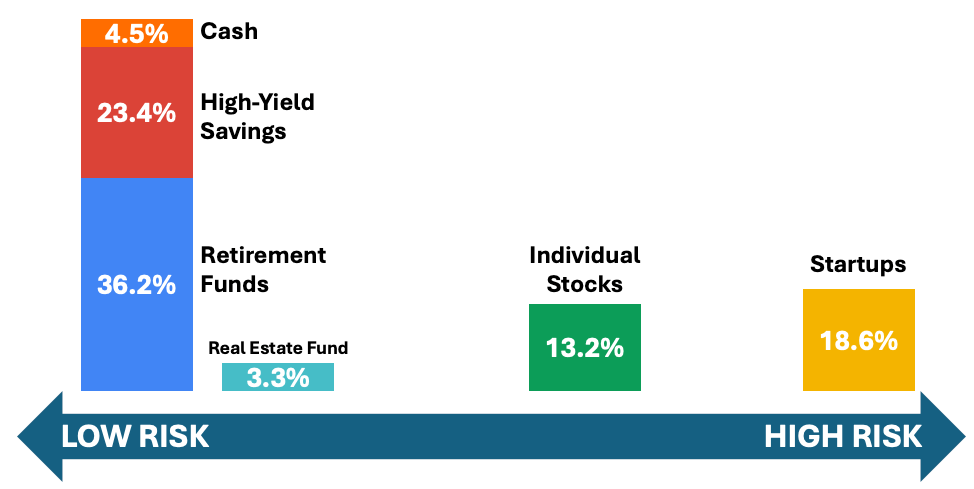

Below is my allocation of assets and where they fall on the risk spectrum:

I have almost 19% allocated to high-risk startups, which is in the top bound of the typical barbell strategy. This would normally be a bit higher, but with interest rates where they are, I’m currently allocating a higher portion of my money to safe assets than I normally would.

Namely, the amount I have in a high-yield savings account (23.4%) is higher than usual because I simply can’t pass up a ‘risk-free’ 4% interest on my funds. (I use and love Wealthfront, and will always share my referral code if you want a boosted 4.5% APY)

I’ve been tracking this stuff for 7 years, so let me go through each investment type and the returns I’ve seen thus far. Starting with the absolute least risky…

COLD HARD CASH (4.5%)

Whenever possible, I pay for things using a few of the credit cards I have to get the 1-2% in cashback rewards. I also have autopay set up on everything so that I never have to pay interest on my balances.

I try to keep just enough cash (checking/paper bills) to cover the credit card bills, my rent payment, and other expenses - as well as a little buffer to make sure I’m never faced with a cash crunch.

The reason for this is ~inflation~.

Inflation is mostly used negatively in the press but it’s a pretty normal economic event, the U.S. government typically targets a ~2% inflation rate with its monetary policy.

When inflation surpasses the 2% pace, that’s when it’s not great because things get expensive faster than wages can keep up.

My cash (and yours) gets less valuable if we just keep it sitting around. If inflation causes eggs to go from $5 → $6, my idle cash is suddenly able to purchase less eggs. Aka: the cash loses value.

The investment return of cash then, is inversely tied to inflation at negative 2% (give or take), which is why I try to minimize the amount of cash that I keep on hand and in my checking.

HIGH YIELD SAVINGS (23.4%)

When interest rates are high, high-yield savings accounts can pay a high interest rate (also known as APY).

Wealthfront, Marcus, and other players will buy Treasury bills, which currently have a 4.34% yield (interest rate).

They then offer consumers a 4% interest rate, and pocket the difference from the treasury bills they own.

Why wouldn’t consumers just go direct and buy Treasury bills at the higher yield? It boils down to two reasons:

The UI of the Treasury Department is super clunky to navigate, whereas Wealthfront/Marcus have sleek interfaces and are easy to use

Treasury bills can be sold before the maturity date, but it’s a bit complex and more risky to rely on secondary t-bill markets. Wealthfront lets you withdraw your cash whenever you want, no fees and at face value.

Most consumers are willing to sacrifice the 0.34% delta between the Treasury Bills and High Yield Savings account rate for a better experience and increased liquidity.

I currently have 23.4% allocated to high yield savings and my annual return has fluctuated with the APY (mostly between 2-5%, currently at 4%)

RETIREMENT FUNDS (36.2%)

This is pretty boring even though it makes up the largest part of my net worth at 36.2%.

If your employer has a 401k match program, absolutely max out that match that they’re offering. It’s free money.

I’ve contributed anywhere between 3-12% of my salary to my 401k over they years. Right now it’s at 6%.

The only thing I do that might be a bit unique is I never rollover my 401k, despite having worked at 4 different companies.

Some 401k providers will charge upwards of $200 to rollover your funds to your new account. As long as you keep track of the accounts you have, there’s no need to roll over your 401k.

I also like to see the performance that each 401k provider has against one another over the years - good for knowing which money managers are actually doing a good job.

Not rolling over your 401k is so minor, but I had to throw in something to spice up the dusty old retirement section.

REAL ESTATE FUND (3.3%)

Since 2018, I’ve had money in Fundrise. They’ve used customer deposits to build a real estate portfolio that pays out dividends and can appreciate in value.

The downside is that due to the illiquid nature of the underlying assets, you need to keep your funds invested for a minimum of 5 years or face a small penalty fee.

My last deposit with them was in January of 2021 - since then, I’ve only managed a 3.58% annual return.

It’s been pretty underwhelming - given that I can get a higher/safer return with Wealthfront (4%) and have near instant liquidity. I’m likely going to withdraw from Fundrise and reallocate elsewhere at the end of the 5 years unless performance picks up.

INDIVIDUAL STOCKS (13.2%)

I’ve been an active investor in stocks since May of 2015.

I’ve seen a total return of 136% over that time period, which comes out to 8.9% return each year.

Pretty good until you see that the S&P 500 has delivered a 12.99% annual return in that same timeframe (including dividends for both calculations).

I really enjoy investing in individual stocks so I’ll keep a portion allocated here, but I’ve slowly been transferring some of my stock portfolio to the S&P 500 since active managers rarely outperform the broad market.

The reason for this, is that a single individual stock can have a really outsized effect on the market. In the 1st half of 2024, Nvidia alone accounted for ~33% of the S&P 500’s total return.

Index funds will typically have exposure to these outliers whereas individual stock-picking won’t.

STARTUPS (18.6%)

Hey did you know that I invest in startups???

I’ve constructed a portfolio of 46 startups over the past decade, many of those investments coming in the last 3-4 years.

Startups take 7-12+ years to materialize and (hopefully) have an exit, so time will tell how my portfolio performs. As it stands now, I’m very optimistic about my prospects.

There’s a few that have emerged into cash machines, and with the power law of startup investing that’s all you need to see a strong return.

I write about startups all the time so don’t need to share more here, but if you want to see a (now outdated) view of my portfolio I last updated it publicly in November of 2024.

That’s it for today, let me know below how you liked this one!

Did you like this article?