NEW STARTUPS

Startups that you can invest in with as little as $100 right now:

☀️ Stellaris - Transparent solar panels for windows (LINK)

👶 Dopple - subscriptions and finances for parents (LINK)

🎮 Evermoon - Games studio with 1M users and counting (LINK)

The Rule of 40: What Startup Investors Need to Know

If you've been poking around the world of SaaS (software-as-a-service) or subscription-based startups, you may have heard whispers about something called the Rule of 40.

Once heralded by venture capitalists, is it still relevant today? And more importantly, should you care?

Let's break it down.

What Is the Rule of 40?

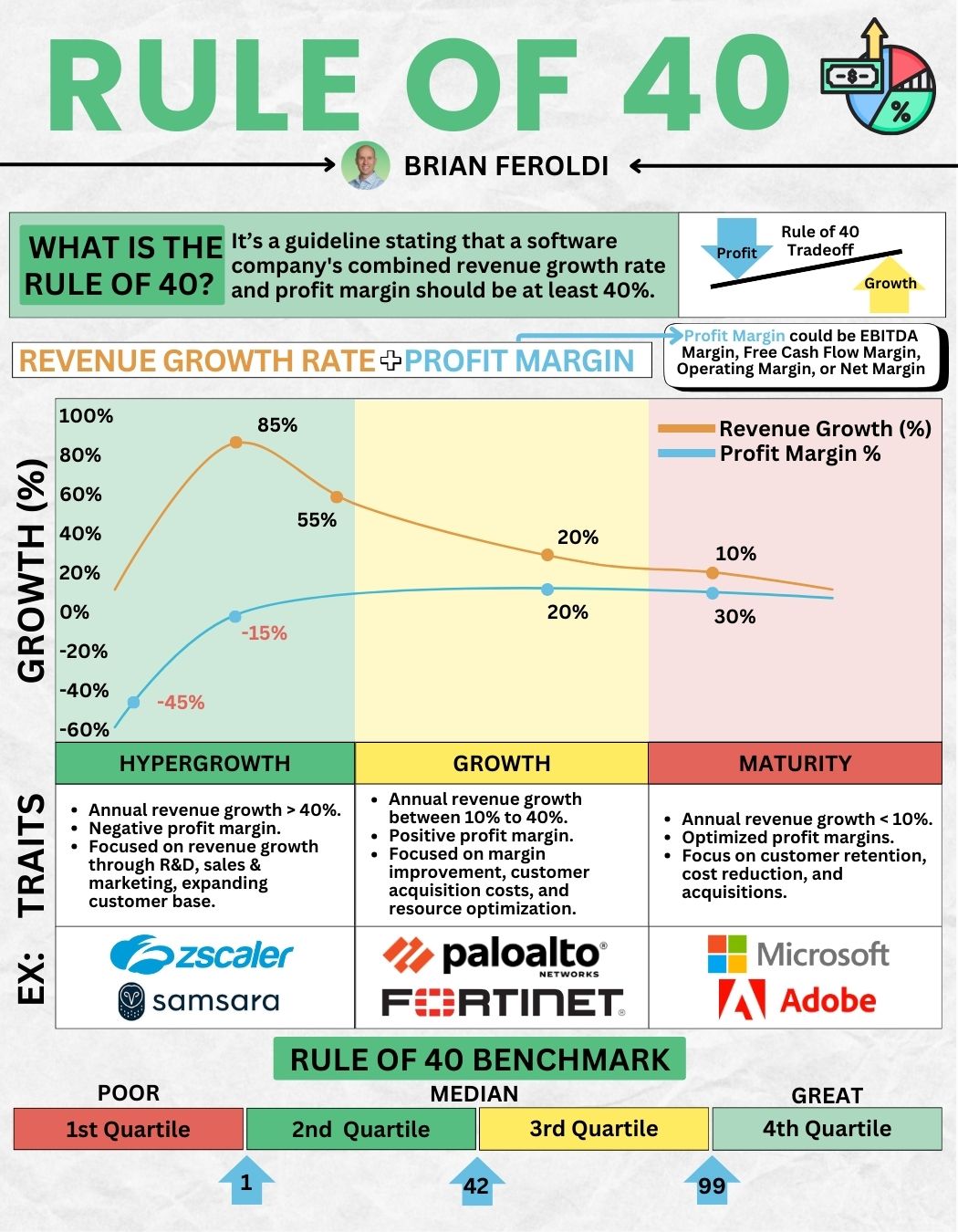

The Rule of 40 is a simple formula used to assess the financial health of a SaaS or subscription company. It says that a company's revenue growth percentage plus its profit margin percentage should equal at least 40%.

the Rule of 40 can work across startups, regardless of their company stage

For example:

A company growing at 30% per year with a 10% profit margin hits the Rule of 40 (30 + 10 = 40).

A company growing at 50% per year but losing 10% on margins also hits the Rule of 40 (50 - 10 = 40).

It's meant to give investors a quick way to gauge whether a company is striking the right balance between growth and profitability.

Why does this matter? Because companies can grow fast and burn through cash, or they can be profitable but stagnant. The Rule of 40 tries to give a blended view that says, "Hey, either approach is okay — as long as the sum is healthy."

Take the company I mentioned in the top section, Dopple. They’re high-growth (+234%), but also highly unprofitable (-151% net income). This would give them a combined score of 83, which would pass the test.

Who Created the Rule of 40?

While there's no single "inventor" of the Rule of 40, it rose to prominence among venture capitalists and SaaS operators in the mid-2010s. It became popular as a shorthand to assess the efficiency of growth-stage companies, particularly after SaaS valuations became heavily tied to revenue multiples.

Bessemer Venture Partners (BVP), one of the most influential SaaS investors, helped amplify it across the industry. But nowadays, it’s torn on whether the rule still applies in today’s startup ecosystem.

Does the Rule of 40 Still Apply? Introducing the Rule of X

Recently, some investors (including BVP themselves) have been rethinking the Rule of 40. In their article, The Rule of X, Bessemer argues that the "40" number might no longer capture how modern SaaS companies perform.

Why? Because today's market increasingly rewards hypergrowth over profitability (we’re so back). Many top-tier SaaS companies outperform peers not by hitting 40%, but by prioritizing aggressive revenue expansion, even if it means running losses.

Enter the Rule of X: instead of sticking to a fixed 1-to-1 balance between growth and profit, this approach suggests weighting growth more heavily. For example, investors would score companies as:

Rule of X = ('X' × Revenue Growth %) + Profit Margin %The X is subject to the particular company being evaluated - what growth stage it’s in, what interest rates look like, and more.

So, a SaaS company growing 40% per year with a –5% margin under Rule of 40 scores 35% (40 - 5), but under Rule of X, it may score 75% ((2 × 40) - 5), making it look far healthier.

What's the Difference, and Why Does It Matter?

The core issue here is how much you value growth vs. profit.

The Rule of 40 assumes equal weight: every 1% of growth offsets 1% of margin. But the Rule of X reflects what many investors now believe: that growth is simply worth more.

Think of it this way: if you’re a SaaS startup in a $10 billion market, the race is to capture share quickly, not to squeeze out every dollar of profit. Investors believe that you can fix margin later, but you can’t make up for lost time in market share.

So, the Rule of X challenges the Rule of 40 by arguing that it undervalues growth. Instead, we should adjust the multiplier on growth based on a company’s stage and market conditions.

Why I Think the Rule of X is a Flawed Evolution of the Rule of 40

The premise behind the Rule of 40 makes sense. It recognizes that a SaaS company can be healthy even if it's unprofitable, as long as it’s growing fast enough. For retail investors looking at startup deals, it's a good reminder not to get spooked by negative EBITDA or laser-focused on top-line growth alone.

I understand the thinking behind the Rule of X, and why Bessemer sees it as an evolution to the Rule of 40.

But here’s the problem: the multiplier applied to growth is extremely subjective.

In the Rule of X, who decides whether you should weight growth 2×, 3×, or 1.5×? Different investors will apply different weightings, often based on gut feeling, market fashion, or peer pressure. That means you can easily spin the numbers to make almost any company look like a winner.

And that, to me, limits the practical value of these formulas.

Call It What It Is: A Quick Check on Topline Metrics

Let’s be clear: the Rule of 40 is not some ironclad law of startup success. It’s a quick screen to spot whether a company is wildly off-balance.

It doesn’t tell you:

Whether the company has strong customer retention

Whether its sales efficiency (LTV/CAC) is sustainable

Whether gross margins are hiding under big marketing bills

In fact, companies can game the Rule of 40 by pulling back on R&D or customer success spending, just to shore up short-term margins.

So if you're a retail investor reading a startup's campaign deck or community round pitch, remember: hitting the Rule of 40 (or even Rule of X) is just a signal, not a guarantee.

Final Takeaway

The Rule of 40 has been a valuable shortcut for SaaS investors, but it’s not the final word. For startup investors participating in crowdfunding rounds, especially those who don’t have access to deep diligence tools, it offers a fast check on whether a company is balancing growth and profit at a glance.

But like any shortcut, it needs context.

Remember: investing in startups isn’t about chasing a perfect scorecard — it's about understanding why the numbers look the way they do.

Did you like this article?